Humana Medicare Supplement Plan Reviews

Founded in 1961, Humana has grown into one of the nation’s largest health insurers, serving about 8.7 million Medicare members as of 2023 across all 50 states, Washington, D.C., and Puerto Rico. Initially rooted in the nursing home industry, Humana is now a leading health and wellness company with a comprehensive portfolio of Medicare offerings that include Medicare Supplement Insurance (Medigap).

Humana’s size and scope allow for extensive options and resources, including valuable wellness perks like SilverSneakers fitness membership, vision and hearing discounts, and 24/7 access to health care professionals. While Humana offers more plan variety than many competitors, potential enrollees should be aware of higher-than-average premiums and complaint rates.

Read on to learn why Humana made our list of the best Medigap carriers and whether their plans might suit your needs.

Humana Medicare Supplement Pros and Cons

Pros

- Extensive plan selection: Humana markets many standardized Medigap plans, including A, B, C*, F*, G, N, and in some states K and L. Not all eight are available in every ZIP code. (*C and F are only for people eligible before 2020.) This is twice as many as the six plans offered by competitors like Cigna.

- Valuable wellness benefits: During our examination of supplemental benefits, we discovered Humana includes SilverSneakers fitness membership at no additional cost, a valuable perk that many competitors charge extra for or don’t offer at all.

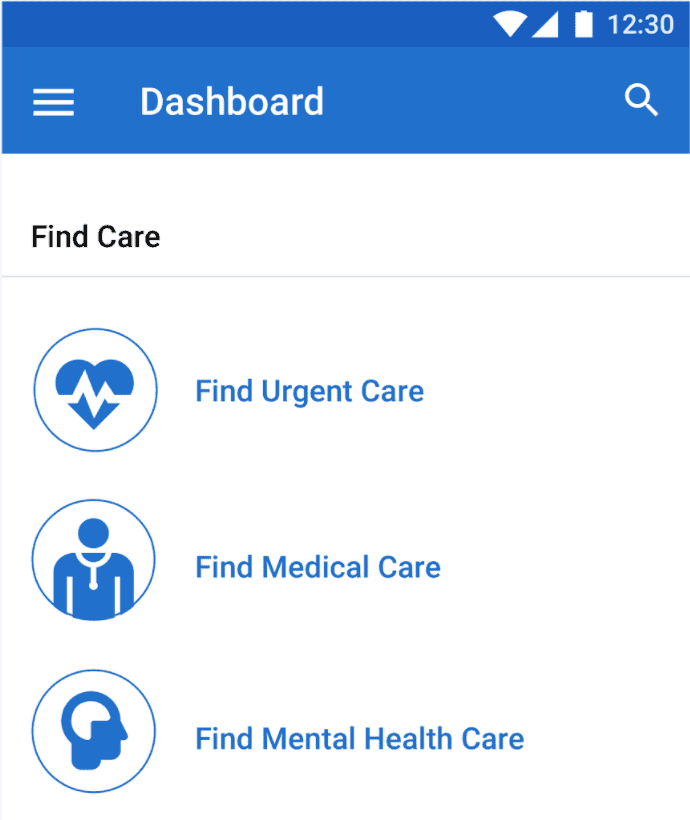

- User-friendly digital tools: Humana’s website and mobile app provide clear plan comparisons, easy enrollment, and comprehensive account management features that exceed industry standards.

- Multiple discount opportunities: Humana offers household discounts that are often 5%, though some states provide an enhanced 12%. It also offers a 6% online enrollment discount in most states (not available in CA, CT, OH, or PA), plus a $2/month automatic payment discount.

- Nationwide availability: Our research confirmed that Humana offers Medicare Supplement plans in all 50 states, unlike some competitors with more limited geographical coverage.

Cons

- Higher premiums: When comparing costs across markets, we found Humana’s base premiums for identical Medigap plans are typically higher.

- Above-average complaint rates: According to our National Association of Insurance Commissioners data analysis, Humana receives nearly nine times as many complaints when compared with the industry average for its Medicare Supplement plans.1

- Inconsistent plan availability: Our investigation of coverage options showed that Humana did not offer all eight plan types in every ZIP code, potentially limiting plan choices in certain areas.

- Lower household discount: Our comparative analysis found that Humana’s 5 percent household discount falls below the industry average, with competitors like Aetna offering up to 7 percent and Mutual of Omaha providing discounts up to 12 percent.

- Limited premium stability: Our evaluation of rating methodologies indicated that Humana often uses attained-age pricing, but pricing methods vary by state and by underwriting entity (attained-age, issue-age, or community-rated).

Overview of Humana’s Medigap Plans

Let’s examine the specific Medicare Supplement plans Humana offers and their benefits. For a 65-year-old male living in Wynnewood, Pennsylvania, there are six options. However, in other locations, Humana also offers plans C, for those Medicare-eligible before 2020, as well as plans K, L, M, and D. Plan F also has a high-deductible option, which wasn’t included as an option when we requested a quote in July 2025.

| Plan | F | G | N | A | B | G High Deductible |

|---|---|---|---|---|---|---|

| Monthly premium range* | $231.07-$265.43 | $192.31-$220.85 | $144.66-$166.05 | $188.51-$216.49 | $190.39-$218.65 | $62.57-$71.64 |

| Annual deductible | $0 | $0 | $0 | $0 | $0 | $2,870 |

| Hospital (Part A) deductible | $0 | $0 | $0 | $1,676 | $0 | $0 |

| Medical (Part B) deductible | $0 | $257 | $257 | $257 | $257 | $257 |

| Part A coinsurance, hospital costs up to 365 days after Medicare benefits are used | Yes | Yes | Yes | Yes | Yes | Yes |

| Part B coinsurance or copayment | Yes | Yes | Some office visits: Copay of up to $20ER visits: $50 copay | Yes | Yes | Yes |

| First 3 pints of blood | Yes | Yes | Yes | Yes | Yes | Yes |

| Part A hospice care coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes |

| Skilled nursing facility care coinsurance | Yes | Yes | Yes | No | No | Yes |

| Part A deductible coverage | Yes | Yes | Yes | No | Yes | Yes |

| Part B deductible coverage | Yes | No | No | No | No | No |

| Part B excess charge | Yes | Yes | No | No | No | Yes |

| Foreign travel emergency (up to plan limits) | Yes | Yes | Yes | No | No | Yes |

*For a 65-year-old male living in Montgomery County, Pennsylvania

Note that for plan F, you must have been Medicare-eligible before 2020 only.

When comparing Medigap plans, it’s important to remember that all Medigap policies are standardized, meaning the benefits for each lettered plan are identical across all insurance companies. The differences lie in premiums, customer service, and extra benefits. This standardization makes it easier to compare plans based on cost and company reputation rather than coverage details.

To learn more about how Medigap standardization works, read our full guide to Medigap plans.

Finding the Right Humana Medigap Plan for Your Needs

Our analysis shows that Humana’s six Medigap plans offer more options than many competitors, such as Cigna, which offers only four plans in most areas. Let’s explore which of Humana’s available plans might best suit different healthcare needs and preferences.

Basic Coverage for Essential Protection

Our research indicates that Plans A and B could be appropriate for those seeking minimal supplemental coverage at a lower cost. Plan A is the most basic option, covering core benefits like Part A coinsurance, hospice care coinsurance, and Part B coinsurance. Plan B adds coverage for the Medicare Part A deductible, offering slightly more protection against hospitalization costs.

Our analysis suggests that with these plans, you are responsible for skilled nursing facility coinsurance and Part B deductibles. They do, however, provide essential protection against potentially high coinsurance costs for hospital and medical services.

Quick Tip: Based on our research, Plans A and B typically have lower premiums but higher potential out-of-pocket costs compared to more comprehensive plans like F and G. Plans A and B are therefore potentially suitable for healthier beneficiaries who expect minimal health care utilization.

Balanced Coverage With Predictable Costs

Analyzing premium structures and coverage levels, we found that Plan N presents an effective middle ground. This plan features moderate monthly premiums while covering 100 percent of most benefits. Based on our research, you’ll pay up to $20 for certain office visits and up to $50 for emergency room visits that don’t result in hospital admission. You’ll also be responsible for any excess charges when providers bill above Medicare-approved amounts.

Our comparative analysis revealed Plan N is particularly popular among beneficiaries who want substantial coverage without the premium costs of Plans F or G.

International Coverage for Frequent Travelers

Our examination of Humana’s plans revealed that Plans F, G, and N include emergency benefits for foreign travel. This coverage applies to medically necessary emergency care outside the U.S. during the first 60 days of a trip. Based on our analysis of plan documents, these plans pay 80 percent of emergency care costs after you meet a $250 yearly deductible (up to plan limits).

Comprehensive Coverage With Plans F and G

Our research indicates that Plans F and G are Humana’s premier options for those seeking the most robust protection. Plan F (available only to beneficiaries eligible for Medicare before 2020) covers all Medicare gaps, including the Part B deductible and excess charges. Plan G offers identical benefits except for the Part B deductible.

When evaluating value propositions, we found Plan G often represents better overall value, as its premium savings compared to Plan F typically exceed the annual Part B deductible amount. Humana offers high-deductible versions of both plans in some markets, featuring significantly lower premiums but requiring you to pay a deductible ($2,870 in 2025) before coverage begins.

Understanding Humana Medigap Plan Costs

Based on our research, Humana’s Medicare Supplement premiums vary significantly depending on your geographic location, age, gender, and the specific plan you select.

When comparing Medigap providers, we discovered that premium differences represent the primary distinction between companies offering the same standardized plans. Our conversations with Medicare specialists revealed the importance of comparison shopping and considering additional value factors beyond the monthly premium.

Humana offers a 12 percent household premium discount, somewhat higher than the industry average. Additionally, Humana provides a 6 percent discount for online enrollment in most states (but not in California, Connecticut, Ohio, or Pennsylvania) and a $2 monthly discount for automatic payments. For comparison, our research of competitors showed that household discount rates range from as low as 5 percent to as high as 14 percent, with Mutual of Omaha offering one of the highest discounts at 12 percent, equal to Humana.

Based on quotes we gathered during our research for a 65-year-old in a Northeastern suburban area, Humana’s premiums typically run 40 to 50 percent higher than the lowest-cost alternatives for identical plans. However, our analysis shows that their discount programs can substantially narrow this gap for eligible applicants.

According to a 2024 study by the American Association for Medicare Supplement Insurance,2 Medigap premiums can vary by hundreds of dollars between insurers for the exact same coverage in a given area.

Did You Know? The International Myeloma Foundation reports that seniors with Medigap policies typically experience fewer concerns about unexpected medical costs, leading to better utilization of necessary healthcare services than those with Medicare Advantage or original Medicare alone.3

Sample Premium Ranges

Based on quotes we gathered during our research, here’s an example of Humana’s pricing structure for a 65-year-old nonsmoking individual in a Northeastern suburban area:

| Plan | Monthly premium range |

|---|---|

| F | $231.07-$265.43 |

| G | $192.31-$220.85 |

| N | $144.66-$166.05 |

| A | $188.51-$216.49 |

| B | $190.39-$218.65 |

| G High Deductible | $62.57-$71.64 |

*Premium ranges shown before any applicable discounts

Our comprehensive review of Humana’s pricing across multiple markets indicates their premiums tend to be higher than those of many competitors. For example, in our sample quotes, Humana’s Plan G premiums were typically about 46 percent higher than the lowest-priced alternative in the same area, and Plan N premiums were approximately 48 percent higher. However, their discount programs can significantly reduce these amounts for eligible applicants.

Enrolling in a Humana Medicare Supplement Plan

Based on our examination of the enrollment process, here’s a streamlined guide to applying for Humana Medicare Supplement coverage:

- Visit Humana’s Medicare Supplement website and enter your ZIP code and basic information to see available plans.

- Compare the displayed plans side-by-side, reviewing coverage details and premium costs.

- Keep your Medicare card nearby, as you’ll need your Medicare effective dates to continue.

- Answer the qualifying questions to determine eligibility and rates.

- Complete the application online and choose from flexible payment options, including automatic bank drafts or credit cards, with a $2 monthly discount for automatic payments.

Money-Saving Tip: Shopping around and changing Medigap plans can result in savings of hundreds of dollars in annual premiums while maintaining identical coverage.

Comparing Humana to Other Medigap Providers

Our comprehensive analysis of Medicare Supplement providers revealed significant differences in plan offerings, pricing structures, and additional benefits. When comparing Humana with major competitors, we discovered several vital distinctions that might influence your choice.

Humana and Cigna: Contrasting Approaches

While both companies offer competitive online enrollment discounts (6 percent for Humana versus 5 percent for Cigna), our research revealed substantial differences in plan variety and supplemental benefits. The most significant distinction we identified was in plan selection: we got six options, whereas Cigna only gave us five, not offering Plan F. But overall, Cigna had lower minimum prices by an average of 62 percent.

| Minimum monthly premium | Humana | Cigna | Difference |

|---|---|---|---|

| F | $231 | N/A | N/A |

| G | $192 | $133.70 | 44% |

| N | $145 | $88.61 | 63% |

| A | $189 | $124.44 | 51% |

| B | $190 | $124.60 | 53% |

| G High Deductible | $63 | $47.32 | 32% |

| Average | $168 | $103.73 | 62% |

Additionally, our evaluation of supplemental benefits found that Humana includes SilverSneakers fitness membership at no additional cost, a valuable wellness benefit that Cigna doesn’t offer. However, Cigna’s 7 percent household discount exceeds Humana’s 5 percent discount.

Humana Compared to Mutual of Omaha: Premium Stability and Discounts

Both Humana and Mutual of Omaha offer 12 percent household discounts. However, unlike with Cigna, which was always cheaper than Humana, some plans were more or less expensive with each provider. For example, while Humana’s Plan A costs 10 percent more than Mutual of Omaha’s, its Plan G was 20 percent cheaper.

| Minimum monthly premium | Humana | Mutual of Omaha | Difference |

|---|---|---|---|

| A | $189 | $172.02 | 10% |

| B | $190 | $176.16 | 8% |

| F | $231 | N/A | N/A |

| G | $192 | $239.89 | -20% |

| G High Deductible | $63 | $63.78 | -2% |

| N | $145 | $155.22 | -7% |

| Average | $168 | $161.41 | 4% |

A significant distinction between the insurance companies concerns premium stability. Mutual of Omaha offers more community-rated plans (where premiums don’t increase based on age) compared to Humana’s predominant use of attained-age pricing. This could represent meaningful savings over time despite potentially higher initial costs.

Additional Benefits

Medicare Supplement plans offer standardized core benefits regardless of the insurer, but our investigation into Humana’s supplemental offerings uncovered several distinguishing features. Although these extras don’t alter the fundamental Medigap coverage, our analysis suggests they may enhance overall value for members.

SilverSneakers Fitness Program

Humana’s supplemental benefits include a SilverSneakers fitness membership at no additional cost, a significant value-add compared to many competitors. Based on our analysis, participants have access to over 15,000 participating fitness locations nationwide, including specialized classes designed for seniors.

Our comparative research of similar programs suggests many competitors either charge extra for fitness benefits or don’t offer them at all. The National Institute on Aging notes that regular exercise can help seniors manage common chronic conditions,4 making this benefit particularly valuable for Medicare beneficiaries who prioritize preventive health care, such as seniors with diabetes or other chronic conditions.

Wellness Discount Program

Humana’s wellness discount program gives members access to reduced rates on various health-related services and products. Based on our analysis, participants can save on vision care, hearing aids and services, prescription medications, and alternative treatments.

When evaluating similar offerings across the Medicare Supplement market, we found Humana’s approach comparable to discount programs from companies like UnitedHealthcare’s AARP Medigap plans. Humana’s wellness discounts were somewhat less comprehensive than premium membership programs like those offered by Medicare Advantage plans, however.

Around-the-Clock Health Consultation Access

Our evaluation of Humana’s support services suggests that their 24/7 nurse advice line is a particularly valuable feature. This service connects members with registered nurses who can provide clinical guidance, answer health questions, and determine appropriate levels of care.

Humana’s support services are comparable to that of industry leaders, such as Cigna. Our assessment suggests that this service provides substantial practical value and peace of mind for members with health questions outside normal business hours.

Evaluating Humana’s Customer Service Experience

Humana offers subscribers multiple contact channels for help, but we identified some potential concerns regarding customer satisfaction. In our research of regulatory data from the NAIC, we discovered Humana’s Medicare Supplement plans generate almost nine times more customer complaints relative to their market share than the industry average. This finding suggests possible challenges with claims processing, billing accuracy, or policy administration.

Humana Medicare Supplement members have several ways to access assistance:

- Telephone support via dedicated numbers (8 a.m. to 8 p.m., seven days a week)

- Online portal

- Smartphone app

Humana’s digital tools exceed industry standards; their mobile app, for example, offers comprehensive account management features that many competitors lack. However, our research identified limited in-person support options compared to insurers with dedicated local agents. This puts seniors who prefer face-to-face assistance with complex insurance matters at a potential disadvantage.

Humana Medicare Supplement Service Area

Humana offers Medicare Supplement Insurance plans in all 50 states, Washington, D.C., and Puerto Rico, providing exceptional geographical coverage compared to many competitors. This puts Humana ahead of companies like Aetna, which doesn’t offer plans in eight states, and on par with UnitedHealthcare/AARP’s nationwide presence.

According to recent data, Humana serves a significant number of Medicare Supplement Insurance beneficiaries, with approximately a 2 percent share of the total Medigap market. This positions the company as a midsized player in the Medicare Supplement space, with a broader reach than many regional insurers.

While Humana maintains a nationwide presence, our analysis of service availability revealed that plan options vary considerably by location. Humana doesn’t offer all eight of their plan types in every ZIP code. This means the specific Medigap options available to you may vary.

Assessing Humana’s Financial Stability

Our analysis of Humana’s financial foundation reveals important considerations for prospective Medicare Supplement policyholders. Since Medigap plans represent a long-term financial relationship, our research team prioritized evaluating Humana’s ability to reliably meet future claim obligations.

Our examination of corporate financial indicators identified several key insights:

Corporate Scale and Resources: Humana maintains a strong position as one of the nation’s largest health insurers, demonstrating substantial financial capacity and business stability.

Medical Loss Ratio Performance: During our investigation of regulatory filings, we discovered Humana directs approximately 82 percent of Medigap premium dollars toward member benefits. This is slightly below the industry average of 84 percent but well above the required minimum medical loss ratios of 65% for individual and 75% for group Medigap policies.

Broader Market Positioning: Humana serves a substantial customer base across diverse insurance product lines, including Medicare Advantage and Medicare Part D plans. This suggests robust overall business operations and reduced vulnerability to segment-specific challenges.

As with any insurance decision, we recommend considering multiple factors beyond financial metrics. Be sure to take into account plan availability in your area, premium costs, customer service quality, and supplemental benefits when deciding whether Humana is the right Medigap choice for your specific needs.

>> Read More: Humana Medicare Advantage Review

Methodology

Here’s how we evaluated Humana’s Medicare Supplement offerings:

Plan Availability Analysis: We analyzed which of the standardized Medigap plans Humana offers across different states, comparing its selection to industry norms and competitors’ offerings.

Premium Cost Evaluation: We gathered premium data from multiple geographical regions to compare Humana’s pricing against the lowest available alternatives in each market. We calculated percentage differences to quantify their competitive position.

Discount Structure Analysis: We researched all available discounts, including household and online enrollment savings, calculating potential maximum savings for various applicant profiles.

Complaint Data Assessment: We examined complaint data from the National Association of Insurance Commissioners to calculate Humana’s complaint ratio relative to market share and compared it to industry averages.

Additional Benefits Comparison: We evaluated Humana’s supplemental offerings, including the SilverSneakers program and wellness discounts, comparing their accessibility and value to similar programs from competitors.

Customer Service Evaluation: We assessed service availability across multiple channels, including phone hours, online portal capabilities, and mobile access, comparing it against industry standards.

Market Position Research: We analyzed Humana’s market share, geographical coverage, and financial indicators to determine its position and stability in the Medicare Supplement Insurance market.

Our analysis weighted factors based on their importance to Medicare beneficiaries, with cost, coverage, and customer satisfaction metrics receiving the highest priority in our final assessment.

Conclusion

Humana’s Medicare Supplement Insurance plans stand out for their wide range of options and extra perks like a free SilverSneakers membership. Many markets offer eight standardized plans, and the online enrollment process is simple, with a large discount available for some applicants. However, the company’s Medicare Supplement customers complained to the NAIC nearly nine times as it should for a company of its size, which gave us pause.

Yet, for beneficiaries who value flexible plan choices and wellness benefits, Humana can be a strong fit, especially if they qualify for multiple discounts. Even with higher complaint ratios, the combination of benefits, availability, and ease of enrollment may make Humana worth the investment.

Frequently Asked Questions

-

Which Medicare Supplement plans does Humana offer?

Humana offers A, B, C*, F*, G, N, and in some states K and L, plus High-Deductible G. (*C/F only if Medicare-eligible before 2020.)

-

Does Humana offer High-Deductible Plan G?

Yes, our research confirmed that Humana offers High-Deductible Plan G in some areas. This plan provides the same comprehensive coverage as standard Plan G but with a significantly lower monthly premium. The trade-off is that you must pay a higher deductible before coverage begins.

-

How does Humana's pricing compare to other Medigap providers?

While Humana was more expensive than all of Cigna’s plans, in some cases, it was more or less expensive compared to Mutual of Omaha. The premiums will depend on the person’s age, location, and health.

-

What discounts does Humana offer on Medicare Supplement plans?

Humana offers several discount opportunities that can collectively save members up to 18 percent on premiums. These include a 12 percent household discount for those who live with another person, a 6 percent discount for online enrollment (not available in California, Connecticut, Ohio, or Pennsylvania), and a $2 monthly discount for automatic payment enrollment.

-

Is Humana a good choice for Medicare Supplement Insurance?

Humana is a solid choice for Medicare Supplement Insurance, particularly for those who value plan variety, wellness benefits like SilverSneakers, and user-friendly digital tools. However, their higher-than-average premiums and significantly above-average complaint rates are important considerations.