Estate Planning: Everything You Need to Know

While it might not be the most glamorous task, estate planning can save a plethora of complications in the wake of a loved one’s passing. Regardless of how much a person owns, if they pass away without a plan, they risk being unable to bequeath their belongings to the right people.

Failing to leave a plan for an estate means leaving loved ones unprepared for the decisions they must make and the potential obstacles created by state and local laws that may hinder the intended inheritance. They may also run into issues with higher-than-necessary taxes. Leaving a clear estate plan helps the individual in question and those closest to the complexities of this process. Whether you have millions in the bank or just a modest home and some sentimental heirlooms, having a plan is non-negotiable.

Tip: Don't let the legal jargon scare you. At its core, estate planning is simply writing down your instructions so others don't have to guess what you wanted.

What Is Estate Planning?

Many people assume estate planning is only for the wealthy—something for people with yachts and summer homes. That is a huge misconception. Your “estate” is simply everything you own: your car, home, checking account, investments, life insurance, and personal possessions. No matter how large or modest, you can't take it with you.

Estate planning is the process of designating who will receive these assets and when. But it goes beyond just stuff. A comprehensive plan also appoints the people who will make financial and medical decisions for you if you become unable to speak for yourself.

Why Estate Planning Matters

Estate planning allows a person to decide how their assets are inherited. Estate planning also provides an opportunity for an individual to make decisions about their own health, future medical care, and funeral arrangements while they are still capable.

This can help ensure that their wishes are followed even if they become incapacitated. It can also make some of these decisions easier for family members that otherwise may be left to make choices without a roadmap. Coping with a loved one’s passing is already difficult enough; the last thing you want is to have family members squabbling over entitlements.

Considering people can die at any age, there is no ideal age at which estate planning should be done. Anyone with financial assets should consider how they want them handled in the event of their passing.

FYI: While planning an estate, many legal and official documents should be organized and stored in a safe place where they can be accessed as necessary by authorized persons.1

Four Key Components of Estate Planning

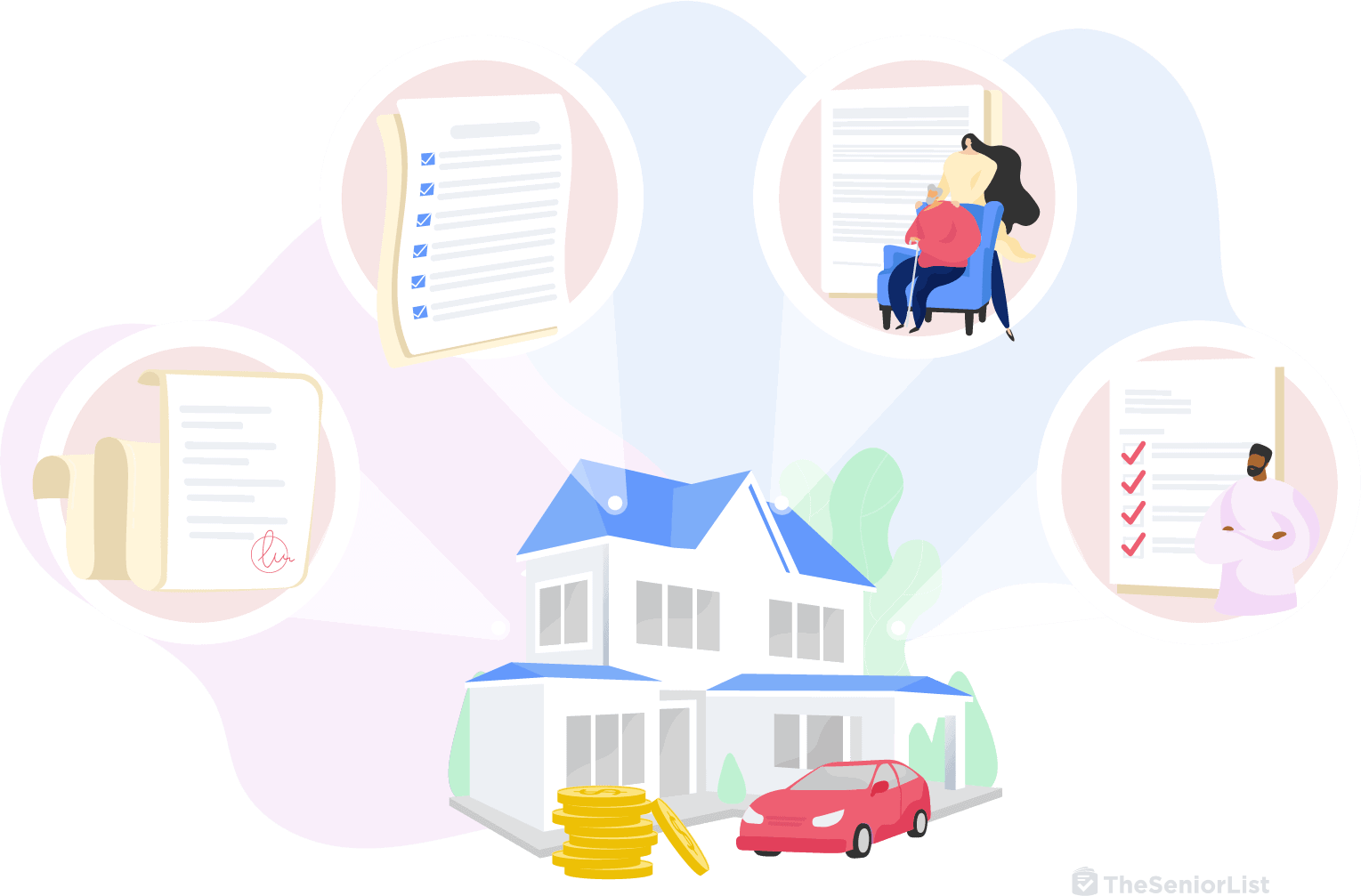

To have a rock-solid plan, there are four key documents you generally need to have in place. Think of these as the pillars of your estate plan.

1. Last Will and Testament

This is the foundation. A will tells the court exactly how you want your assets distributed. Without it, a judge who doesn't know you or your family will decide who gets what based on state laws. In your will, you also name an executor—the person you trust to carry out these instructions.

2. Revocable Living Trust

While a will is crucial, it has one major downside: it generally has to go through probate, which is a court-supervised process that can be slow and expensive. A revocable living trust allows your assets to pass directly to your beneficiaries without court intervention, saving time and money. Plus, it remains private, unlike a will, which becomes public record.

FYI: A living will differs from a Do Not Resuscitate (DNR) or a Do Not Intubate (DNI) order. According to the Mayo Clinic, these can be included in a living will but should also be added separately to a person’s medical file with their primary physician.2

3. Durable Power of Attorney (Financial)

If you were to have a stroke or an accident and couldn't manage your bills or bank accounts, who would step in? A durable power of attorney designates an “agent” to handle your financial affairs immediately if you become incapacitated. Without this, your family might have to go to court to get guardianship, which is a nightmare you want to avoid.

4. Advance Healthcare Directive

The Advanced Healthcare Directive is sometimes called a Living Will or Medical Power of Attorney, but they are not the same. The former is a document that guides your doctors and family regarding your medical care if you cannot communicate. It covers tough decisions like life support, tube feeding, and pain management.

A Note on Estate Taxes for 2025

One of the biggest worries I hear is, “Will the government take half my money?” For most Americans, the answer is a resounding no. The federal estate tax exemption has been adjusted for inflation. For the tax year 2025, the federal estate tax exclusion amount is $13.99 million per individual.3

This means you can leave nearly $14 million to your heirs without paying a dime in federal estate tax. For a married couple, that protection doubles to nearly $28 million. Unless your estate exceeds these high thresholds, your focus should be more on probate avoidance and family harmony than on federal taxes.

Additionally, if you want to give money away while you are alive, the annual gift tax exclusion for 2025 is $19,000.4 You can give this amount to as many individuals as you like each year without it counting against your lifetime exemption.

DIY vs. Hiring an Attorney

With the rise of online legal services, you might be tempted to go the DIY route to save a few dollars. Online wills can cost as little as $100 to $200, while a simple estate plan with an attorney might run up to $5,000, depending on where you live.5

My advice? Proceed with caution. If your situation is straightforward—say, you are single with no children and very few assets—an online form might suffice. But for most older adults, especially those with blended families, real estate in multiple states, or a desire to set up a trust, the money spent on an experienced elder law attorney is worth every penny. A single mistake in DIY wording can invalidate a will or cause tax headaches that cost your heirs far more than you saved.

FYI: Don't forget your digital life! Make a list of your online accounts (email, social media, banking) and instructions on how to access or close them. This is a critical part of modern estate planning.

Getting Started Checklist

- Take Inventory: List out your assets (home, accounts, investments) and debts.

- Choose Your People: Decide who you trust to be your executor, trustee, and power of attorney.

- Consult a Pro: Find a specialized estate planning or elder law attorney.

- Sign and Notarize: make your documents official.

- Communicate: Tell your family where the documents are kept. Hiding your will helps no one!

Conclusion

I know this feels like a lot to take in. But remember, you don't have to do it all in one day. Start by taking inventory, then make that appointment with a professional. Once you have these documents signed and stored safely, you will feel a weight lift off your shoulders that you didn't even know you were carrying. That peace of mind? It is the best legacy you can leave.