The 3 Best Prescription Discount Cards for Seniors

If you’re using multiple prescriptions, prices can add up quickly, which is why many people are turning to prescription discount cards. These cards can not only give you discounts on drugs but also show you the prices you’ll pay at various pharmacies. On this page, I’ll tell you about my favorite prescription discount cards for seniors. I’ve tested and evaluated each for the size of their discounts, their availability at local pharmacies, and how many drugs they covered.

Our Top-Rated Prescription Discount Cards

- GoodRx : Lowest Prices

- SingleCare : Free Membership

- WellRx : Most Medications Covered

Prescription Discount Cards Compared

|

GoodRx

|

SingleCare

|

WellRx

|

|

|---|---|---|---|

| Rating out of 5 | 4.9 | 4.2 | 4.6 |

| Monthly Cost |

|

$0 |

$0 |

| Accepted At | 37,000 pharmacies |

Over 35,000 pharmacies |

65,000 pharmacies |

| Prescription Costs* |

|

|

|

| Read More | GoodRx Review |

*Costs represent findings from pharmacies in New York City. Costs may vary by location and pharmacy.

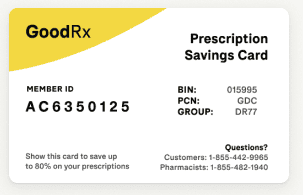

1. GoodRx - Lowest Prices

What We Like Most:

- Free to use

- Optional telehealth services

- Medication delivery

- Paid membership for greater discounts

Overview

Every time I entered a medication on the GoodRx website, I was shocked to see how low the prices were. While GoodRx claims to offer discounts of up to 80 percent, I saw discounts of as high as 97 percent. This was truly shocking — on a medication that originally cost nearly $250 the price dropped to less than $8. If you are willing to drive a little out of the way for a significantly cheaper medication, GoodRx will save you the most.

The company offers discounts on over 10,000 different medications in 37,000 pharmacies across the U.S. When I did a search in Brooklyn, New York, I found 90 pharmacies near me.

But one thing that made GoodRx stand out even more was its telehealth option, which costs either $49 a visit for non-members or $19 for people with GoodRx Gold memberships. The Gold memberships are available in every state except Washington for $9.99 a month for an individual, or $19.99 a month for a family of six, including pets. If you have a more routine illness, like a UTI, or you simply need a refill on an existing prescription, a telehealth appointment is a convenient and affordable way to get a prescription. Neither SingleCare nor WellRx offers telehealth, so this definitely made GoodRx stand out from its competitors.

Pros

- Up to 97 percent discount on more than 10,000 medications

- 37,000 pharmacy locations, including CVS, Rite Aid, and Publix

- GoodRx Gold membership unlocks even more savings plus free delivery on over 950 prescriptions

- Telehealth option available for either $19 or $49 a visit for Gold members and non-members, respectively

Cons

- Gold membership is not available in Washington state

- Gold membership will cost $9.99 a month for an individual after the first 30 days

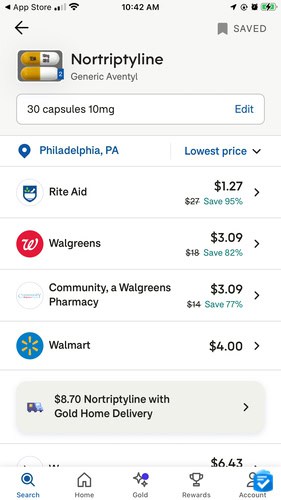

2. SingleCare - Free Membership

View Packages

Links to SingleCare

View Packages

Links to SingleCare

What We Like Most:

- Accepted at over 35,000 pharmacies

- Deep discounts on medications

- Useful smartphone app

- No fees for membership

Overview

Unlike GoodRx, which has an optional paid membership program for more savings, it’s completely free to use SingleCare with or without a membership, although members will get even lower prices. The company offers customers savings of up to 80 percent for over 10,000 drugs. Its availability is great too. Customers can live in the U.S. and in Puerto Rico, and SingleCare can be used in over 35,000 pharmacies such as CVS, Fred Meyer, and Walmart.

While its prices aren’t quite as low as GoodRx’s (at least on the medications I looked up), the fact that membership is free means there’s nothing to lose. When you create an account with SingleCare you’ll get more savings, completely free.

That being said, SingleCare doesn’t have all the bells and whistles of GoodRx, like telehealth, for example. But if all you want are cheaper prescriptions, it’s likely SingleCare can get you there, with an easy-to-use website and mobile app.

FYI: To learn more about this service, read our guide: SingleCare vs. GoodRx.

Pros

- No fee for membership

- Up to 80 percent off drugs

- More than 10,000 drugs covered at over 35,000 pharmacies

- Works in both the U.S. and Puerto Rico

Cons

- Not the highest discounts for medications, on average

- No telehealth option

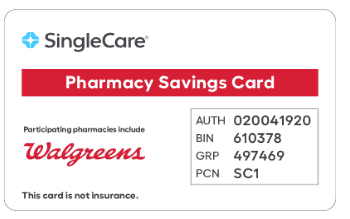

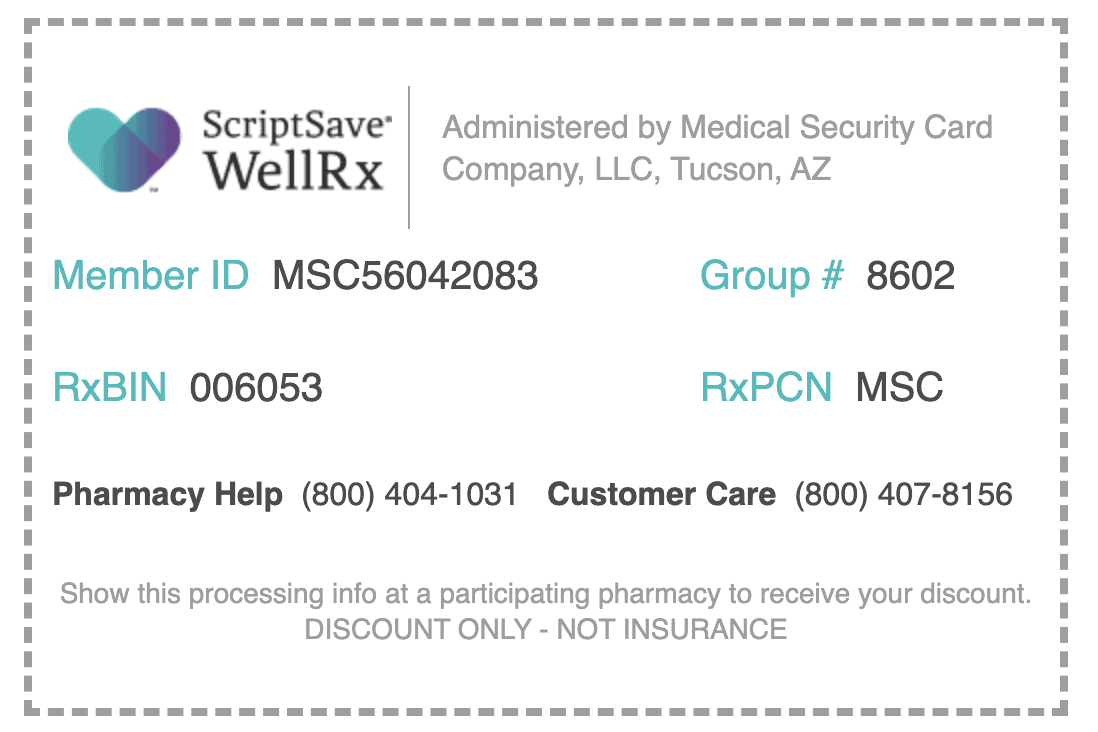

3. WellRx - Most Medications Covered

What We Like Most:

- Largest number of covered medications

- Accepted at thousands of pharmacies nationwide

- App and online discount cards

- Medication reminder feature

Overview

Last but certainly not least is WellRx, which covers more medications than SingleCare and GoodRx combined: over 85,000 medications are accepted at 65,000 pharmacies in every state in the U.S. As someone searching for a refill in New York, I found nearly 100 pharmacies in Manhattan. (I would have preferred to stay in Brooklyn, but you can’t have it all.) To compare, GoodRx showed me 90 pharmacies in Brooklyn alone.

With WellRx, I could save up to 80 percent on the cost of prescriptions. But unfortunately, the prices were higher than GoodRx and SingleCare, for the most part. With so many medications covered, it may be your only option for more obscure medications. WellRx is also accepted at the highest number of pharmacies. So it may be your only option, depending on where you live. If GoodRx and SingleCare aren’t available in your area or don’t cover your medication, WellRx is still worth it over paying full price for your meds. (Although, on average, GoodRx and SingleCare are cheaper.) I say it’s still worth looking into!

Pros

- Savings of up to 80 percent on medications

- More than 85,000 drugs covered at 65,000 pharmacies in the U.S.

- Strong iOS app

- Medication reminders in app

Cons

- Coverage is sparse in some states

- Discounts aren’t the biggest (on average)

Honorable Mentions

Of course, these aren’t the only prescription discount cards on the market. While I tested out the following services, they didn’t quite make the cut.

- Blink Health: While Blink Health offers the same maximum 80 percent savings as the other companies on this list, I only found 20 pharmacies when I entered my Brooklyn zip code. Companies like GoodRx and WellRx gave me nearly 100.

- Costco Prescription Program: Participating in the Costco Prescription Program requires a Costco membership, which starts at $60 a year and goes all the way to $120. Considering companies like GoodRx, WellRx, and SingleCare let you save for free, it’s only worth doing this program if you already have a Costco membership.

- Optum Rx: Optum Rx is a free prescription delivery service. However, it’s only available to people who get their health insurance from a UnitedHealth Group brand, like UnitedHealthcare, so it won’t be an option for many people with other providers or no healthcare provider.

- RxSaver: Owned by GoodRx, RxSaver is a very similar service, but I found it had higher prices for many of the prescriptions I looked up.

Our Methodology

I considered many factors when selecting my choices for Best Prescription Discount Cards, but these five held the most weight. These are also topics you’ll want to revisit as you determine which prescription discount card is best for you.

- Savings: In this category, I looked at the percentage of the discount offered on commonly prescribed medications and the total amount I stood to save.

- Coverage: I took note of how many drugs the card covered, how many pharmacies partnered with our card provider, and how close those pharmacies were in relation to my address.

- Reliability: No one wants to get held up at the pharmacy counter, so I visited local pharmacies to ensure that these prescription discount cards actually worked.

- Extra features: Some prescription discount cards offer extra features like smartphone apps, telehealth, and savings on products beyond medications. I factored these in as well.

Our Findings Broken Down

In the chart below, you’ll find the out-of-pocket costs (with each prescription discount card) for several prescription drugs commonly used by seniors.

| Prescription | SingleCare Cost | GoodRx Cost | WellRx Cost |

|---|---|---|---|

| Simvastatin | $9.44 | $7.96 | $11.50 |

| Lisinopril | $2.51 | $2 | $6.23 |

| Levothyroxine | $3.25 | $8.51 | Not covered |

| Amlodipine Besylate | $2 | $7.28 | $5.93 |

| Omeprazole | $8.99 | $2 | $6.63 |

| Azithromycin | $4.04 | $8.95 | $71.15 |

| Metformin | $2 | $5.07 | $4 |

| Hydrochlorothiazide | $2 | $1.01 | $4 |

These are the lowest prices for 20 milligrams, or 30 tablets, of each drug, for a zip code in Brooklyn, New York.

The High Cost of Prescription Medication

Each year, Americans spend over $450 billion on prescription medications –– more than $1,100 for each person –– and this figure accounts for common discounts and rebates. With this in mind, it shouldn’t surprise anyone that 1 in 3 older Americans has trouble affording their medications.

Fortunately, insurance isn’t the only way to lower those expensive prescription costs and get the medicines you need. Prescription discount cards can help get you some financial relief on your medications as well. Unlike insurance, most of them are totally free to use.

>> Related Reading: Anticholinergic Drugs and Why Some of Them are Dangerous for Seniors

How Prescription Discount Cards Work

Discount programs use the power of bulk purchasing to negotiate savings on medications with pharmacies. This discount is usually a percentage of the cash price but still allows the pharmacy to profit. Whenever a customer uses the savings card, the pharmacy compensates the card company with a small referral fee. The pharmacy benefits from more traffic to their store, the card owners make money, and card users save.

Many prescription discount cards cover FDA-approved prescription medications, but some are limited to a smaller number of drugs. Some cover over-the-counter and pet medications as well. The majority of cards cover both generic and brand-name drugs. Depending on your specific card, pharmacy, and location, savings from your prescription discount card will vary. In most cases, savings will range from 20 to 80 percent. Even $20 of savings per month adds up over time.

Final Thoughts

With so much cash on the line, there’s not much to lose with free prescription discount cards, especially ones that don’t require any personal info. You can even keep them in your wallet or phone at all times, as most are available on mobile apps. If prescription costs are eating away at your savings, then incorporating a prescription discount card into your medication management routine is a great idea.

Whether you use one of our recommendations or find another card using the evaluation system I mentioned earlier, don’t keep paying too much for medication. Also, check out my complete guide to prescription discount cards to learn more. Stay healthy, and enjoy your savings!

Frequently Asked Questions

-

How do prescription discount cards make money?

Each time you use a discount card, the pharmacy pays the card company a small fee for the referral. Some cards charge a monthly subscription fee.

-

Should I ever pay for a discount card?

There are so many free discount cards that it usually doesn’t make sense to pay for one. That said, some paid services like GoodRx Gold might be worth it for some users.

-

What if my pharmacy refuses my prescription discount card?

Should you experience an issue at the pharmacy, call your discount card’s customer service. GoodRx, for example, has individuals ready to help resolve these types of issues.

-

What is a human-equivalent pet prescription?

Since some pet medications are the same as those for humans, pharmacy discount cards will sometimes help pay for these as well. The human-equivalent prescription is what you’ll need to have your veterinarian send to the pharmacy, so they can fill your pet’s medication. It’s essentially the amount a human would take adjusted for weight.