Complete Guide to Medicare in 2025

Medicare Updates that Happened in 2023

- New coverage start dates: Beginning in 2023, when you sign up for Medicare the month you turn 65, during the final three months of your Initial Enrollment Period, or during the General Enrollment Period, your coverage will start the first day of the month following your sign-up.

- Benefits for kidney transplant and immunosuppressive drugs: Medicare will offer a new benefit that helps pay for immunosuppressive drugs beyond 36 months after a kidney transplant, assuming you don’t have other health coverage.

- Additional sign-up times: You may be able to sign up for Medicare during a Special Enrollment Period if you missed your enrollment period because of certain exceptional circumstances.

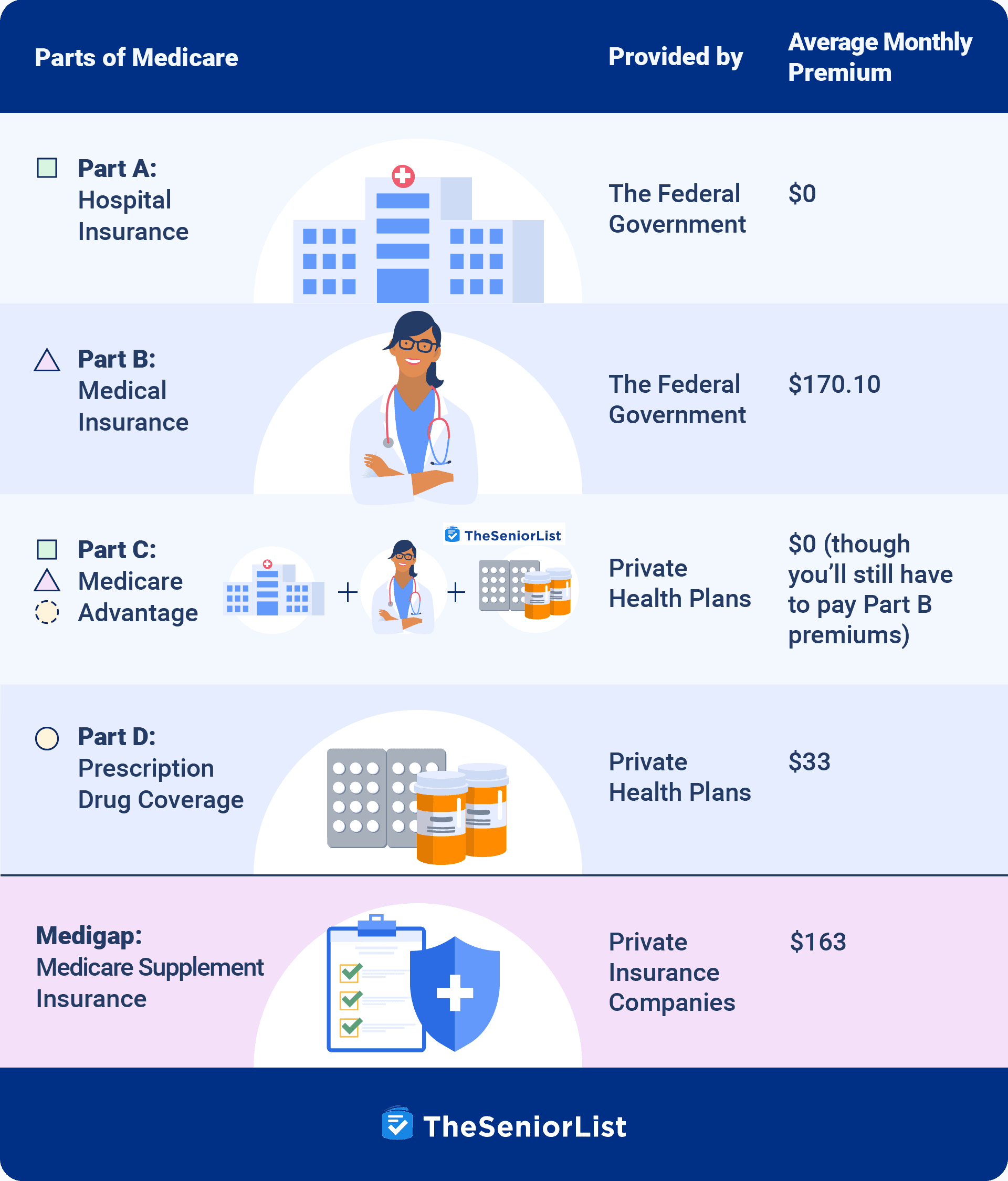

The Parts of Medicare

Medicare consists of four parts that cover different items and services. Original Medicare consists of Medicare Part A and Part B, while Part C and Part D represent additional coverage types.

What Does Medicare Cover?

Medicare Part A (Hospital Insurance)

Medicare Part A covers inpatient services, including hospital stays, skilled nursing facilities, and hospice care. Most Medicare beneficiaries receive Medicare Part A with no premium, since they or their spouse have paid Medicare taxes for at least 10 years. Costs associated with Medicare Part A include a recurring deductible and copayments.

Medicare Part B (Medical Insurance)

Part B coverage includes outpatient medical services, including:

- Physician office visits

- Emergency room visits

- Outpatient surgery

- Diagnostic tests

- Preventive services

- Durable medical equipment

- Prescription drugs administered in an outpatient setting

Most beneficiaries will pay a standard Part B premium ($164.90 for 2023), an annual deductible, 20 percent coinsurance, and up to 15 percent in excess charges.

Medicare Part D (Drug Coverage)

Medicare Part D offers coverage for prescription drugs. These plans are run by private insurance companies contracted and regulated by the Centers for Medicare and Medicaid Services.

These plans include a monthly premium, deductibles, copayments, or coinsurance, and each Part D prescription drug plan has a formulary or covered list of drugs. The formulary list outlines the tier each prescription medication falls under and any prior authorization, step therapy, or quantity limits associated with the plan.

Did You Know: If you have Type 2 diabetes, Ozempic is covered under the majority of Medicare Part D plans.

Your Options for Medicare Coverage

When you initially enroll in Medicare — as well as during certain enrollment periods — you will choose between two primary ways of receiving Medicare coverage.

1. Original Medicare

Original Medicare refers to Medicare Part A and Part B, and it doesn’t include prescription drug coverage. You’ll need to add a stand-alone Part D plan for prescription coverage.

In addition to adding a Part D plan, Original Medicare beneficiaries may consider adding a Medicare supplement insurance plan. These plans help cover expenses such as coinsurance, copayments, deductibles, and coinsurance.

2. Medicare Advantage (Part C)

Medicare Part C, also called Medicare Advantage, combines the benefits of Medicare Part A and Part B in one plan. Medicare Advantage plans are administered by private companies as opposed to the federal government, but they are required to offer coverage that is equal to or greater than Original Medicare.

In most cases, Medicare Advantage plans apply a maximum out-of-pocket limit, as well as additional benefits for hearing, vision, and dental health. Most Medicare Advantage plans also include Part D coverage.

To learn more about Medicare Advantage, read our rundown of this year’s best Medicare Advantage providers.

Original Medicare vs. Medicare Advantage

| Original Medicare | Medicare Advantage (Part C) | |

|---|---|---|

| Network restrictions | Can be used with any health-care provider nationwide that accepts Medicare (which is most providers). | Most Medicare Advantage plans are network based. To be covered, you must use in-network providers except in emergencies. |

| Seeing specialists | Referrals not required | Referrals usually required |

| Out-of-pocket costs |

|

Plans and costs vary. Most have fixed copays for most services. Some services may require a coinsurance or deductible. |

| Monthly premiums | Most people will pay only the Medicare Part B monthly premium ($164.90 in 2023). You’ll also pay an additional premium if you choose a Part D plan. | You’ll continue to pay your Part B premium, and if the plan you enroll in has a premium, you’ll also be responsible for that. Many Medicare Advantage plans have a $0 monthly premium though. |

| Yearly limits | Original Medicare doesn’t have a limit on how much you can pay. | Medicare Advantage plans must provide an annual maximum out-of-pocket limit. |

| Medigap | Yes, you can add a Medigap plan to cover the cost gaps in Original Medicare. | No, you cannot enroll in both a Medicare Advantage and Medigap plan. |

| Coverage of medically necessary services | Yes | Yes |

| Prescription drug coverage | No, you can add a Part D plan for prescription drug coverage. | Yes, most Medicare Advantage plans include prescription drug coverage. |

| Approval of services or supplies | Less restriction on approval of services and supplies. | A more restrictive approval process for services and supplies |

| Foreign health care | No, but you could purchase a Medicare Supplement that would provide emergency foreign travel health care. | No, but some plans may offer a supplemental benefit covering foreign travel emergencies. |

>> Related Reading: Is Medicare Advantage a Scam?

How to Sign Up for Medicare

There are a variety of ways to apply for Medicare. Below are some of the most common scenarios.

You’ll automatically be enrolled in Medicare Parts A and B if:

- You currently receive Railroad Retirement or Social Security benefits. In these cases, enrollment occurs automatically on the first day of your 65th birth month. If your birthday falls on the first day of a month, Medicare will begin on the first day of the previous month.

- You’re under 65 and receive disability benefits from Railroad Retirement or Social Security. In this case, Medicare coverage will begin on the 25th month of disability.

- You’ve been diagnosed with amyotrophic lateral sclerosis or Lou Gehrig’s disease. In this case, Medicare benefits will begin the same month that disability benefits begin.

If you qualify for automatic enrollment into Medicare, you’ll typically receive your Medicare card three months before coverage begins. The Part B premium will begin deduction from your Social Security benefits the month coverage begins.

>> Related Article: Medicare Helpline: Beware of Misleading Advertising

You can delay or decline Medicare Part B, but you could be assessed a penalty if you don’t have other coverage at least as good as Medicare.

You’ll have to sign up for Medicare Parts A and B if:

- You’re approaching 65 and aren’t receiving benefits from Railroad Retirement or Social Security. It’s recommended that you begin the process three months before you turn 65.

- You’re diagnosed with end-stage renal disease under the age of 65

Part A and Part B Enrollment Periods

You can sign up for Medicare Parts A and B only during specific enrollment periods.

Initial Enrollment Period

The Initial Enrollment Period has a seven-month window to enroll in Medicare. It begins three months before you turn 65 and continues for three months after your birth month.

If you enroll before your birth month, the coverage will begin on the first day of the month. Per the new Medicare changes, the coverage will take effect the following month when you enroll after your birth month.

Special Enrollment Period

The Special Enrollment Period is when you lose creditable coverage. You have an eight-month window to start your Medicare coverage when this occurs. COBRA isn’t considered creditable coverage for Original Medicare. If you plan to begin COBRA, you should start Medicare to avoid any late-enrollment penalty.

Beginning in 2023, additional Special Enrollment Periods allow you to sign up for Medicare. An example of the change would be if you missed your sign-up period because of a natural disaster.

General Enrollment Period

Suppose you miss your Initial Enrollment Period and don’t qualify for a Special Enrollment Period. You’ll have to wait until the General Enrollment Period to start Medicare. The GEP runs annually from January 1 through March 31. In 2023, a regulation change allows your coverage to begin the first day of the month following your enrollment.

This change is significant. Previously when you enrolled during the GEP, the coverage wouldn’t begin until July 1.

Do You Have to Pay for Part A?

Most Medicare beneficiaries won’t have to pay a premium for Medicare Part A because they paid Medicare taxes for 40 quarters. These Medicare taxes could have been paid either through your own income or that of a spouse. Forty quarters is 10 years, so if you worked for 10 years and paid Medicare taxes, you qualify for premium-free Medicare Part A.

Beneficiaries who work less than 40 quarters will be required to pay a premium for Medicare Part A. Those who worked 30 to 39 quarters will pay $274 per month, and those who worked less than 30 quarters will be required to pay the total Part A premium of $499 per month.

Part A Late-Enrollment Penalties

If you’re eligible for Medicare, don’t have creditable coverage, and don’t enroll, you may be assessed a Medicare late-enrollment penalty. It’s a 10 percent penalty for each consecutive 12 months you were eligible for Medicare and didn’t have coverage. The penalty will last for twice as long as the period you didn’t have coverage.

If, for example, you were eligible for Medicare for two consecutive 12-month periods, you’d have a 20 percent penalty for the next four years.

Do You Have to Pay for Part B?

Most Medicare beneficiaries will pay the standard Medicare Part B premium, which is $170.10 for 2022. Low-income Americans may qualify for assistance through a state Medicare savings program to pay the monthly premium on their behalf.

Higher-income individuals may be required to pay more due to the income-related monthly adjustment amount, or IRMAA. The IRMAA is based on tax returns from the previous two years, and is calculated based on filing jointly or individually.

Part B Late-Enrollment Penalties

Like Part A, Medicare Part B also has a late-enrollment penalty. It works very similarly to the Part A penalty. For each consecutive 12-month period, there will be a 10 percent penalty based on the standard part B premium. Unlike the Part A penalty, however, the Part B late-enrollment penalty is permanent.

If you were to go for two years without enrolling once you’re eligible, you’d be penalized 20 percent in perpetuity.

What Exactly Does Medicare Cover?

- Original Medicare will cover services and supplies in an inpatient hospital or skilled nursing setting, office visits, outpatient procedures, lab tests, imaging services, durable medical equipment, and drugs administered in a physician’s office.

- You’ll present your red, white, and blue Medicare card to your provider as proof of Medicare coverage, and your health-care provider will bill Medicare directly.

- Original Medicare doesn’t cover prescription medications filled at the pharmacy. Coverage for prescription drugs can be obtained by purchasing a Medicare Part D prescription drug plan.

Part A Coverage

Medicare Part A, also known as hospital insurance, helps cover:

- Inpatient care in a hospital

- Inpatient care in a skilled nursing facility (not custodial or long-term care)

- Hospice care

- Home health care

- Inpatient care in a religious, nonmedical health-care institution

What You Pay

Copayments, coinsurance, or deductibles may apply for these services. The costs may differ if you have Medicaid, Medicare Advantage, or Medigap.

Part A Covered Services

Blood

If you require a blood transfusion, you’re responsible for paying for the first three pints per calendar year. You’re not required to pay if the hospital receives the blood at no cost from a blood bank or through a donation.

Home Health Care

Medically necessary home health care is covered by Medicare Part A and B, depending on the service. To qualify for home health care, you must meet specific criteria.

Your health-care provider must certify that you’re homebound, which means:

- You have trouble leaving your home without help

- The doctor doesn’t recommend that you leave your home due to a medical condition

- You can’t leave home because it takes a significant effort

Home health-care services include:

- Part-time, intermittent skilled nursing care

- Physical therapy

- Speech-language pathology services

- Occupational therapy services

- Durable medical equipment

Hospice Care

If your doctor deems hospice care is needed, you’ll pay $0 for all services. The only exception is a $5 copay for outpatient prescription drugs.

Hospice coverage includes:

- Symptom-management and pain-relief items and services

- Medical services

- Nursing services

- Social services

- Pain- and symptom-management drugs

- Aide services

- Homemaker services

Inpatient Hospital Care

Medicare coverage for inpatient hospital coverage includes:

- Semi-private room

- Meals

- General nursing

- Drugs

- Hospital services and supplies

Part A coverage includes inpatient care in an acute care hospital, inpatient rehab, long-term care, and psychiatric care.

Items not included are private duty nursing, in-room television or phone, and personal-care items such as socks and razors.

Skilled Nursing Care

Part A covers the first 20 days in an inpatient skilled nursing facility. Coverage includes a semi-private room, meals, therapy services, skilled nursing care, and necessary medical supplies. Medicare typically requires a three-day hospital stay for skilled nursing to be covered.

Part B Coverage

Medicare Part B covers outpatient medical services. For all items and services covered under Medicare Part B, the beneficiary is responsible for 20 percent of all costs after they pay their annual Part B deductible. If the services are performed by a provider that accepts Medicare but not Medicare assignment, the beneficiary could be liable for up to a 15 percent excess charge.

Additional items and services for Medicare Part B include:

- Chiropractic

- Chronic care management services

- Clinical research studies

- Cognitive assessment

- Care plan services

- Colorectal cancer screenings

- Barium enema

- Colonoscopy

- Flexible sigmoidoscopy

- Fecal occult blood test

- Multitarget stool DNA and blood-based biomarker tests

- CPAP devices

- Tobacco counseling to prevent tobacco use and tobacco-caused diseases

- COVID-19

- Vaccines

- Antibody tests

- Monoclonal antibody treatments

- Over-the-counter test

- Defibrillators

- Depression screening

- Diabetes self-management training

- Diabetes equipment, supplies, and therapeutic shoes

- Doctor and other physician services

- Drugs administered in an outpatient setting

- Durable medical equipment

- Electrocardiogram

- Emergency-room services

- E-visits

- Eyeglasses after cataract surgery

- Federally qualified health center services

- Flu shots

- Foot care

- Glaucoma tests

- Hearing and balance exams

- Hepatitis B shots

- Hepatitis B virus infection services

- Hepatitis C screening tests

- HIV screenings

- Home health care

- Home infusion therapy services and supplies

- Kidney dialysis services and supplies

- Kidney disease education

- Laboratory tests

- Lung cancer screenings

- Mammograms

- Medicare diabetes prevention

- Mental health care

- Non-laboratory tests

- Nutrition therapy services

- Obesity behavioral therapy

- Occupational therapy services

- Opioid use disorder treatment services

- Outpatient hospital services

- Outpatient medical and surgical services and supplies

- Physical therapy services

- Pneumococcal shots

- Principal care management services

- Prostate cancer screenings

- Prosthetic and orthotic items

- Pulmonary rehabilitation programs

- Rural health clinic services

- Second surgical opinions

- STI screenings and counseling

- Speech-language pathology services

- Surgical dressing services

- Telehealth

- Transitional care management services

- Transplants and immunosuppressive drugs

- Urgently needed care

- Virtual check-ins

- Yearly wellness visits

What’s Not Covered by Part A and Part B?

Medicare covers many items and services, but some items aren’t covered by Medicare. The item or service must be considered medically necessary to be covered by Original Medicare.

Below is a list of items not covered by Medicare:

- Routine dental care

- Eye exams for glasses

- Dentures

- Long-term care

- Cosmetic surgery

- Massage therapy

- Routine physical examination

- Hearing aids, exams, and fittings

- Concierge care

- Covered items from a doctor that doesn’t accept Medicare

Even though Medicare doesn’t cover these items, some Medicare Advantage plans may cover some of them. Low-income beneficiaries with Medicaid may also have coverage for some of the items listed above.