Grandparents Spend an Average of $4,000 a Year on Grandkids

Most grandparents love to provide their grandkids with guidance and gifts without the discipline required of parents. Many share stipends via bills tucked into cards or coins playfully discovered behind ears. Yet, as wealth distribution stagnates and economic realities shift, many grandchildren need more than gifts — they rely upon significant financial support from their elders.

Today, many grandparents help with housing expenses, healthcare costs, tuition, travel, or loans, even as they face their own financial challenges like rising living costs and debt.

To better understand this developing dynamic impacting American seniors, TheSeniorList.com studied more than 1,200 older people about the support they supply to grandchildren. We explored the amount and type of aid they provide, how contributions alter their standard of living, and how their sacrifices change their standard of living. We also dove into the non-financial support they provide their progeny.

Key Findings:

- Each year, grandparents contribute an average of $3,948 to their grandkids of all ages, through gifts, contributions to college funds, or even day-to-day expenses like groceries.

- 1 in 5 supporting grandparents feels pressured to contribute more than they can afford, and 10% have taken on debt or delayed their retirement to help out grandkids.

- 16% of grandparents have at least one grandchild living with them, and 12% of grandparents help pay their grandkids’ rent or mortgage.

- 63% of grandparents say their grandchildren’s happiness is worth any financial sacrifice. Still, over half have had to reduce their contributions due to inflation.

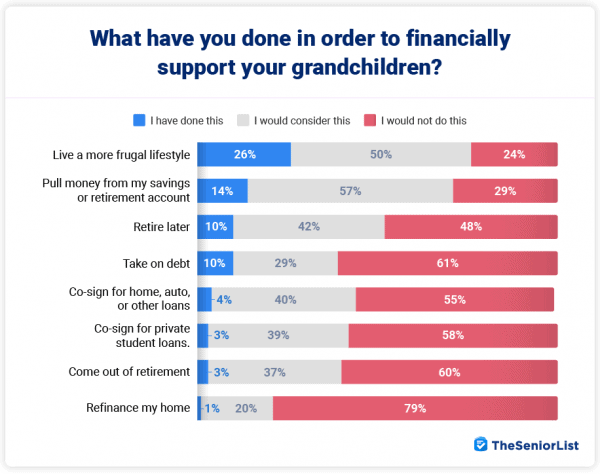

- 26% of older people live more frugally so they can support their grandkids. Half would be willing to postpone retirement, and 40 percent would come out of retirement if necessary to support their grandchildren.

Having Grandkids Costs Money for 96% of Grandparents

Across the U.S., many young adults are struggling to make ends meet. For some, high housing costs and persistent inflation have placed the American Dream on pause. More twentysomethings are living at home than at any time since the 1940s.

In addition to seeking shelter with parents, many young adults receive aid from their grandparents. This approach is as sensible as it is sentimental – older Americans possess a lopsided share of the nation’s wealth. According to estimates from the Census and the Federal Reserve, Americans aged 60 or older comprise nearly 25 percent of the population but hold about 65 percent of the country’s private assets. These holdings will transfer via gifts and inheritances over the coming decades, but many young adults need assistance now. Thankfully, grandparents tend to be giving.

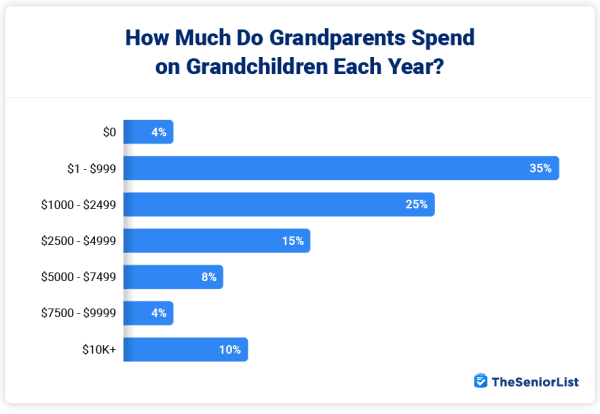

We found that 96 percent financially support their grandchildren in some way, and 16 percent of grandparents have at least one grandchild living with them. More than 60 percent of grandparents contribute at least $1,000 annually to their grandkids, and 10 percent provide $10,000 or more. Grandparents’ total financial support averages $3,948 annually, with a median annual contribution of $1,600.

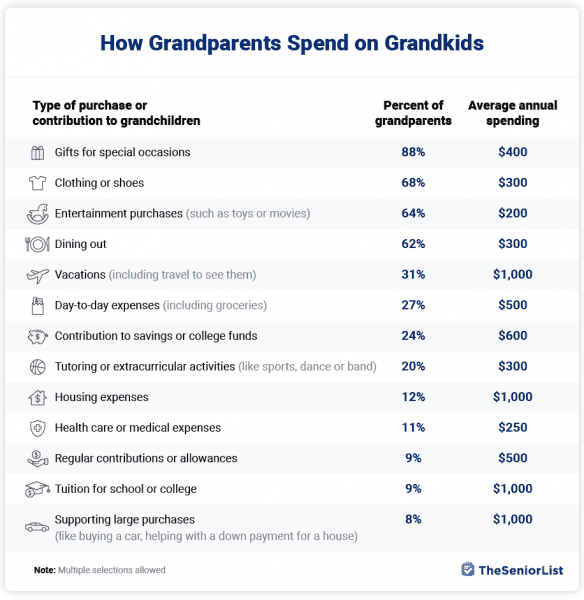

Of course, nine in ten grandparents give gifts for special occasions, averaging $400 annually. Around two-thirds help with clothing, entertainment, and meals. Many other grandparents assist with travel expenses (through vacations or visits), and around one in four contribute to everyday expenses or savings accounts. A significant portion of grandparents also aid with bigger-ticket items, like tuition, tutoring, housing, healthcare, or large purchases. One in ten provides a regular payment or allowance on a weekly or monthly basis.

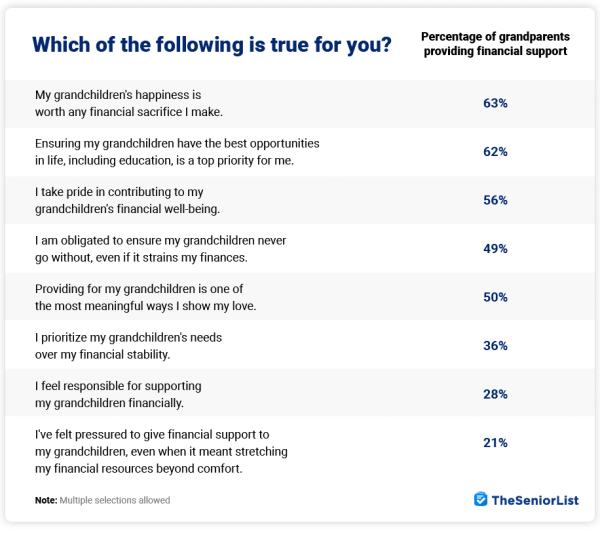

Grandparents help their grandchildren with money for many different reasons. When asked why, some said it’s a way to show love. but others feel they have to. Many also said they want to give their family more chances in life and feel proud to be able to help out financially.

More than a third of grandparents put their grandchildren’s needs ahead of their own financial stability. One in five admitted they felt pressured by family expectations to provide more support than they could afford. Digging into those sentiments, we explored the burdens and sacrifices grandparents have taken on while improving their grandchildren’s lives.

Grandparents’ Generosity Could Impact Their Own Financial Wellbeing

Grandparents demonstrated exceptional selflessness and a willingness to place the needs of their grandchildren first. Despite economic circumstances threatening their financial stability, most older adults are still willing to do whatever it takes to support their grandchildren. Unfortunately, many older Americans feel insecure about their economic situations, and our study showed less than half of seniors believe they’ll remain financially stable throughout retirement.

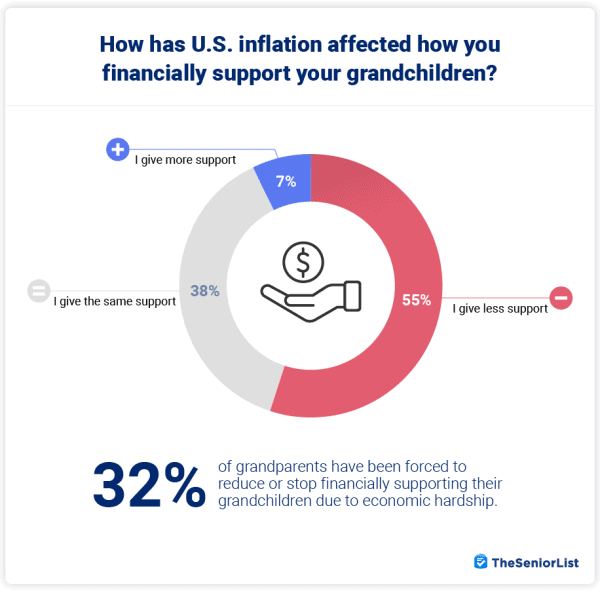

These concerns fuel anxiety in senior circles. Our research showed that more than 75 percent of older Americans are stressed about their ability to live comfortably in retirement. Such dire financial situations and worries have caused 32 percent of grandparents to scale back their support or even cut it off altogether.

An unstable economy can make it harder to help family. Over half of grandparents who provide support have already cut back due to the impact of inflation, while some have increased their help to cover higher costs, making them more vulnerable to price increases.

Placing or investing resources in secure accounts (joint savings, college plans, trust funds, etc.) can help protect against a stormy economy. About 24 percent of grandparents have set aside funds for their grandchildren’s futures, though another 33 percent plan to do so.

Without money put aside, many grandparents must tap into their savings, alter their lifestyles, or risk credit ratings to assist their grandchildren financially. Most are willing to make such sacrifices. Despite unstable budgets and ample anxiety, most older Americans stand ready to forego personal comfort to prioritize the needs of their grandchildren.

Twenty-six percent of grandparents say they’ve lived more frugally so they could support their grandchildren, and another half would consider doing the same. Seventy-one percent are willing to withdraw from savings or retirement accounts, and many are prepared to co-sign on loans or take on more personal debt. Perhaps the ultimate commitment is demonstrated by the majority of grandparents willing to postpone retirement or the forty percent who’d contemplate returning to work to support their grandchildren.

Grandparents’ willingness to make these sacrifices and put their comfort at risk is both touching and admirable, yet far from their only contributions to raising grandchildren.

Grandparents’ Support Extends Well Beyond Money

Financial assistance aids in raising grandchildren and often generates gratitude: 87 percent of grandparents felt appreciated for their contributions. Yet money is only one means of support, and probably not the most important.

Though many grandparents believe financial assistance helps secure independence for their grandchildren, only fourteen percent of grandparents who provide monetary assistance believe the funds ultimately play a significant or critical role in their grandchildren’s success.

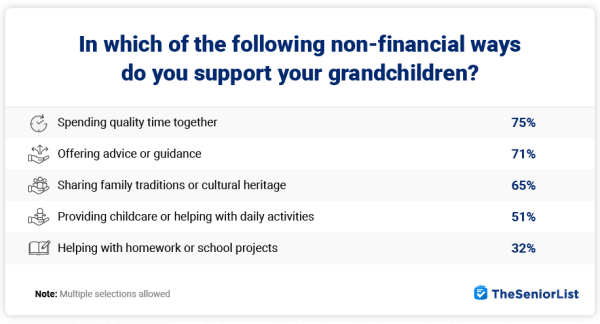

When nurturing children, love proves far more important than dollars. Accordingly, we found grandparents to be as generous with their time as their money. Ninety-four percent cited ways they supply non-financial support to grandchildren, most often via building bonds, offering advice, imparting family traditions, or supervising youngsters and helping with schoolwork.

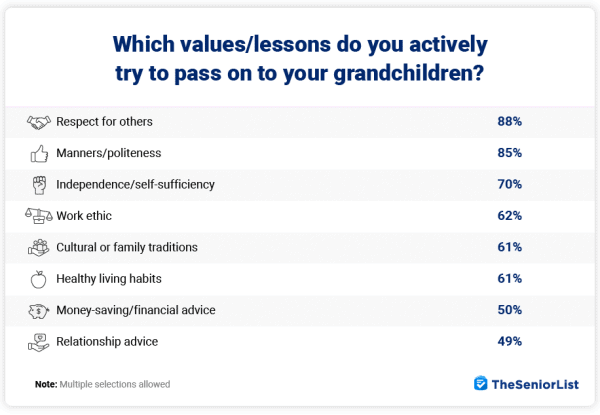

Through these commitments, grandparents provide excellent examples for their grandchildren. They’re also able to impart valuable life lessons, like respect, manners, and self-sufficiency. These were considered the most important. Through their experience and actions, grandparents help positively shape future generations.

Conclusion

With a challenging economy affecting Americans of all ages, members of the older generations are making sacrifices to help the younger ones thrive. Grandparents often serve as the backbone of their families, offering financial support, time, tradition, and wisdom. Our research confirms this view.

Despite concerns about their own financial stability and the possibility of outliving their savings, 96% of grandparents still spend significantly on their grandchildren. On average, they contribute nearly $4,000 a year, with one in four living more frugally to finance their generosity. Many are even willing to dip into their savings, delay retirement, return to work, or refinance their homes to help out their families.

To avoid these sacrifices, more families should plan ahead by setting aside funds for their grandchildren. Smart options include investing wisely, opening college savings accounts, thoughtful estate planning, or using a new “grandparent loophole” that allows contributions to education without affecting financial aid eligibility.

Our Data

We conducted an online survey of 1,209 Americans aged 55+ in August of 2024. Respondents ranged in age from 55 to 92, with a median age of 63. 71 percent were female, 28 percent were male, with 1 percent declining to specify. 82 percent were white, 11 percent were black, 1 percent were Asian, 5 percent were some other ethnicity, and 2 percent declined to specify. 891 respondents had at least one grandchild, with a median number of grandchildren of 3.