Does Medicare Cover Hearing Aids?

Medicare Coverage of Hearing Aids

Despite the prevalence of hearing loss in older adults, Original Medicare covers neither the cost of hearing aids nor routine hearing exams. However, this doesn’t mean you are without coverage. Private insurance and Medicare Advantage plans are among some of the ways I’ve seen clients obtain partial coverage for hearing aids.

Watch this video to learn the basics.

Pro Tip:Looking for high-quality hearing aids for less than $1,000? Then read our rundown of the best cheap hearing aids.

Why Does Medicare Not Cover Hearing Aids?

Medicare was established in 1965, but at the time, it did not cover hearing aids because this technology had a much lower cost. The first in-ear hearing aids were developed in the 1950s and were not as technologically advanced or widely used. Since then, hearing aids have come a long way technologically and, as a result, have become much more expensive. Hearing aids can cost up to $5,000 for a pair, and this does not include the cost of fittings and exams with professional audiologists.

In 2017, the Over-the-Counter Hearing Aid Act was passed, allowing individuals to purchase a hearing aid without an audiologist appointment. This significantly lowered the price of some hearing aids meant for mild to moderate hearing loss. While this act expanded access to hearing aids and lowered costs, it did not expand Medicare to cover the costs of hearing aids.

FYI: Check out my rundown of hearing aids for severe hearing loss to learn about the ideal aids for this type of loss.

Medicare Part A and Hearing Aids

Medicare Part A does not cover the cost of hearing aids. Individuals must pay 100 percent for hearing aids and exams if this is their only medical insurance coverage.

Medicare Part B and Hearing Aids

Medicare Part B covers diagnostic hearing and balance exams if your physician orders this treatment. The typical coinsurance and deductibles are incurred for these appointments. However, Medicare Part B does not cover examinations or fittings for hearing aids or the devices themselves.

Medicare Part C and Hearing Aids

Medicare Part C is considered a Medicare Advantage plan offered by a private insurance company to expand Medicare benefits. Many Part C plans offered by various insurance companies do offer coverage for hearing aids and examinations.

Medicare Advantage plans vary from company to company and state to state. Copays vary by plan from $0 to thousands, so read the fine print on your coverage before committing to a plan.

Medicare Part D and Hearing Aids

Medicare Part D is similar to Part C in that it is offered by private companies as a separate plan to expand Medicare coverage. However, while Part C offers expanded coverage for hearing aids, Medicare Part D plans are solely for covering the costs of prescription drugs.

Medigap and Hearing Aids

Medicare supplemental plans or “Medigap” plans, as they are more commonly known, are private insurance plans that fill in the “gaps” that Medicare does not pay for, such as coinsurance, deductibles, and copayments. These plans are especially useful for those who have diabetes or other healthcare needs that require high out-of-pocket costs. Medigap plans do not cover hearing aids or examinations; however, some providers might offer discounts on particular brands of hearing aids.

Pro Tip: Over-the-counter hearing aids can be more affordable and purchased easily online.

Medicare Advantage and Hearing Aids

Medicare Advantage is a specialized insurance plan offered by private companies to help offset additional healthcare costs that Medicare Part A and B do not cover. Individuals pay for their Medicare Part and B through a private company and receive additional coverage such as dental care, vision, and hearing aids in addition to their federal benefits.

Each Medicare Advantage plan is different. A policy varies depending on the state you live in, how old you are, and what specialized coverage you need. Some plans cover the cost of hearing aids but not audiologist appointments, while others cover audiologist appointments but only from in-network providers, who may not be available in your area. Some plans cover 100 percent of hearing aids, while others only cover up to a certain amount.

A variety of private insurance companies offer Medicare Advantage plans. Aetna’s Medicare Advantage plan offers hearing aid coverage of up to $2,000 per ear. The Humana Gold Plus HMO Medicare Advantage plan has a different breakdown of benefits. Annual hearing exams have a $0 copay. An “advanced” level hearing aid has a $699 copay per ear, per year while a “premium” level hearing aid has a $999 copay per hearing aid, per year. These prices are subject to change based on where you live. These prices may also change depending on the monthly premium you agree to. For that reason, shop around before choosing a Medicare Advantage plan so you purchase one that meets all your healthcare needs.

FYI: Medicare Advantage can also be a great option for oral health. Check out my list of Medicare Advantage for Dental to learn more.

How Much Do Hearing Aids Cost?

The cost of one hearing aid is $2,400 on average; keep in mind that most people will need two hearing aids.

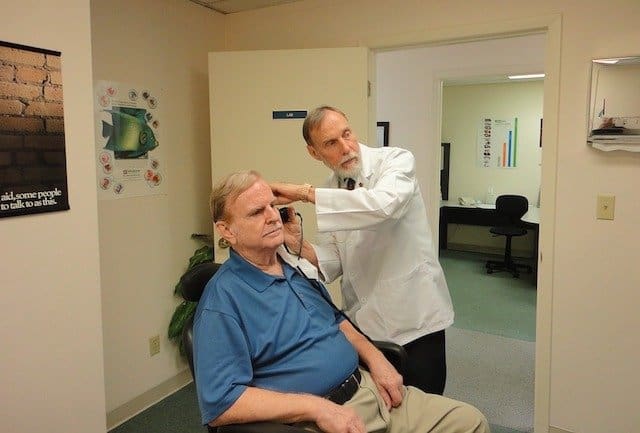

The high cost of hearing aids is in large part because they require a hearing test, consultation with a professional audiologist, fittings, adjustments, hearing aid cleaning, and exams in addition to the actual hearing aids themselves.

Some hearing aids are more advanced, with audio profiles to match the setting (movie theater, restaurant, etc.) and Bluetooth capabilities. Other hearing aids are specialized for tinnitus or severe hearing loss so the technology is more advanced and thus, more expensive.

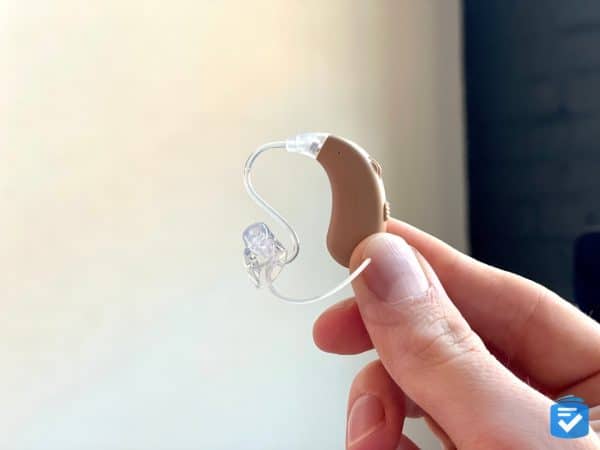

Because every ear is different, it’s important to see an audiologist and get a professional fitting for hearing aids. This professional will help determine your level of hearing loss and what hearing aid will work best for you. Low-cost hearing aids are available over-the-counter and may be purchased online. This is a great option for individuals with mild-to-moderate hearing loss with no severe hearing impediments.

Pro Tip: Check out my list of this year’s best hearing aids to learn more about options available online.

How to Buy Hearing Aids

Your choice of hearing aids will depend on many different factors: your budget, location, health insurance, and level of hearing loss. Our hearing aid buying guide provides a comprehensive breakdown of what to expect when purchasing your first pair of hearing aids. Ultimately, the first person to ask about hearing aids is your primary care physician. They know your healthcare needs and can likely point you in the right direction, whether that be a private audiology practice, an ear, nose and throat (ENT) doctor, or an over-the-counter option.

No matter what option you ultimately end up choosing, there is a Medicare Advantage plan available to help you pay for the costs. The cost is well worth it as hearing aids enhance every aspect of your life: from following along with lively discussions at dinner parties to taking in your favorite movie on a Saturday night.

Frequently Asked Questions About Medicare and Hearing Aids

-

Why does Medicare not cover hearing aids?

In 1965, when Medicare was signed into law, hearing aids were considered low-cost and often not needed, causing those who drafted this federal program to not include them. Unfortunately, Medicare has not been revised to account for today’s high hearing aid costs.

-

What is the five-minute rule for hearing aid batteries?

The five-minute rule helps you to extend the life of your hearing aid batteries. When replacing your batteries, wait five minutes before placing the new batteries inside your hearing aids. This allows the surrounding air to activate the batteries, extending their life by up to a few days.

-

What insurance covers hearing aids?

Most private insurance won’t cover the cost of hearing aids; however, many providers will cover the cost of a hearing exam or hearing aid evaluation. Be sure to check with your insurance provider to see what coverage and discounts they might offer.

-

How much does a hearing aid cost at Costco?

A set of Kirkland Signature hearing aids, available at Costco, can cost as low as $1,399 for a pair, far lower than the industry average.

-

What is the best inexpensive hearing aid?

Since no two hearing losses are identical there is no universal best hearing aid for everyone. With that said, I recommend MDHearingAid, Eargo, and Jabra Enhance hearing aids as some of my favorite budget options.